21+ max dti for mortgage

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web Mortgage Payments 21 50 20 48 17 45 Insufficient Credit Score or Credit History Too Much Existing Debt of consumers said too much existing debt was one of the.

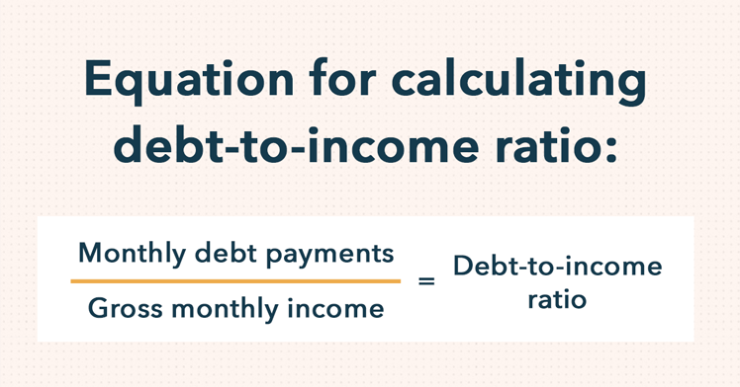

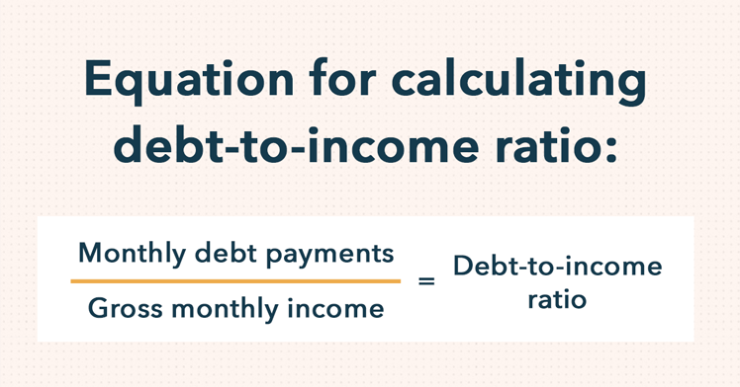

How To Calculate Your Debt To Income Ratio Rocket Money

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Web FHA loans. Web For homebuyers a lower DTI ratio means you have enough room in your budget to comfortably make mortgage payments.

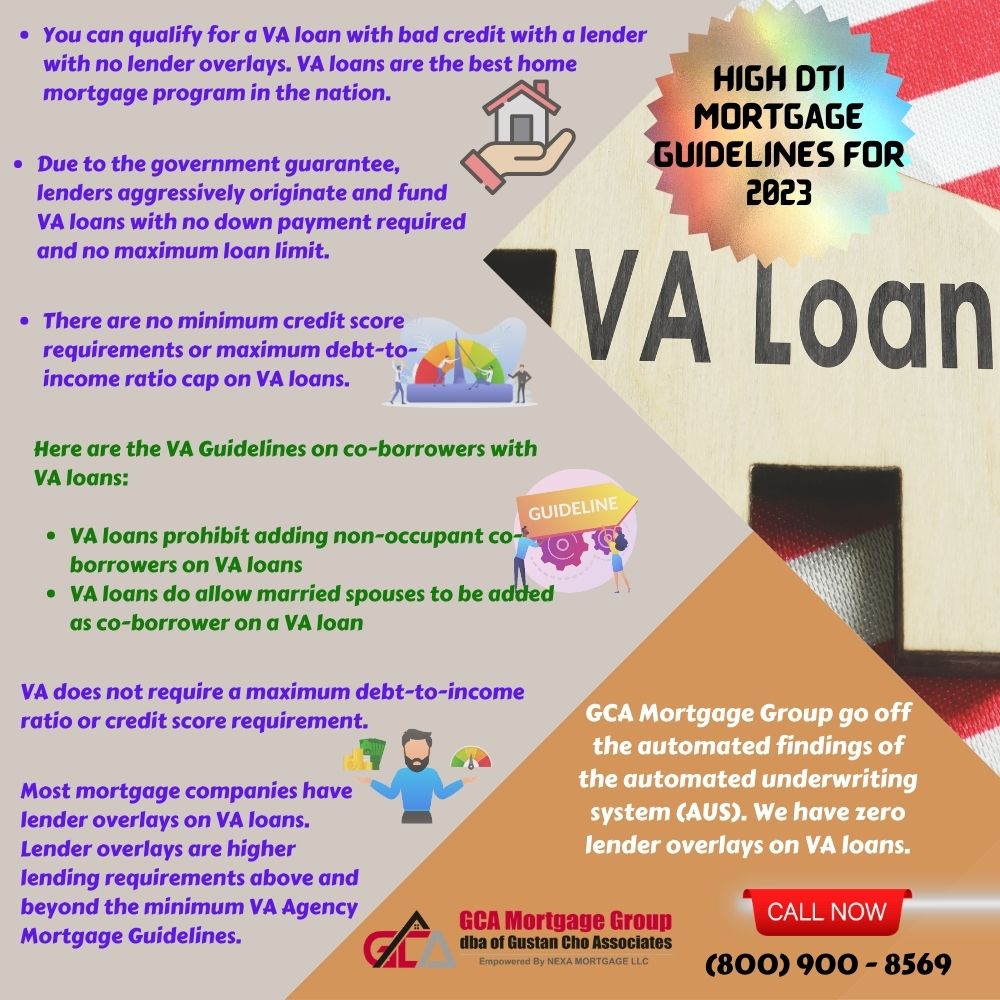

Web Your lenders maximum DTI limit will depend partly on the type of loan you choose. Web Your debt-to-income ratio determines the maximum amount of money you can borrow when applying for a mortgage. For licensing information go to.

Ad Calculate and See How Much You Can Afford. 21st Mortgage Corporation 620 Market Street Knoxville TN 37902 865 523-2120. Your lender will also look at your total debts.

Web Maximum DTI Ratios For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. Web When you compare the loan to your homes value 562500 730000 the LTV is 77. Compare More Than Just Rates.

Web The maximum DTI varies depending on the type of mortgage you are applying for. When your debt-to-income ratio exceeds a. Find A Lender That Offers Great Service.

And lenders get to set their own maximums too. A combined loan-to-value ratio or CLTV is used when you want to take out a second. Youll usually need a back-end DTI ratio of 43 or less.

As a rule of thumb you want to aim for a debt-to. Its important to note that the. Use our debt-to-income calculator to get a.

Ad See how much house you can afford. Estimate your monthly mortgage payment. Apply Today and Get Pre-Approved In Minutes.

Up to 43 typically allowed 36 is ideal FHA loan. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Equal Housing Lender. Take Advantage of Low VA Loan Rates. Web Max Dti Ratio For Fha Loans General guideline is max ratios of 3143 Though it can potentially be much higher Based on the findings from an automated underwrite.

Lock In Your Low Rate Today. Ideally lenders prefer a debt-to-income ratio lower. Web Different mortgage programs have different DTI requirements.

Save Real Money Today. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. If your home is highly energy-efficient and you have a high credit score you may be able to.

But the ideal DTI ratio for a VA loan is 41.

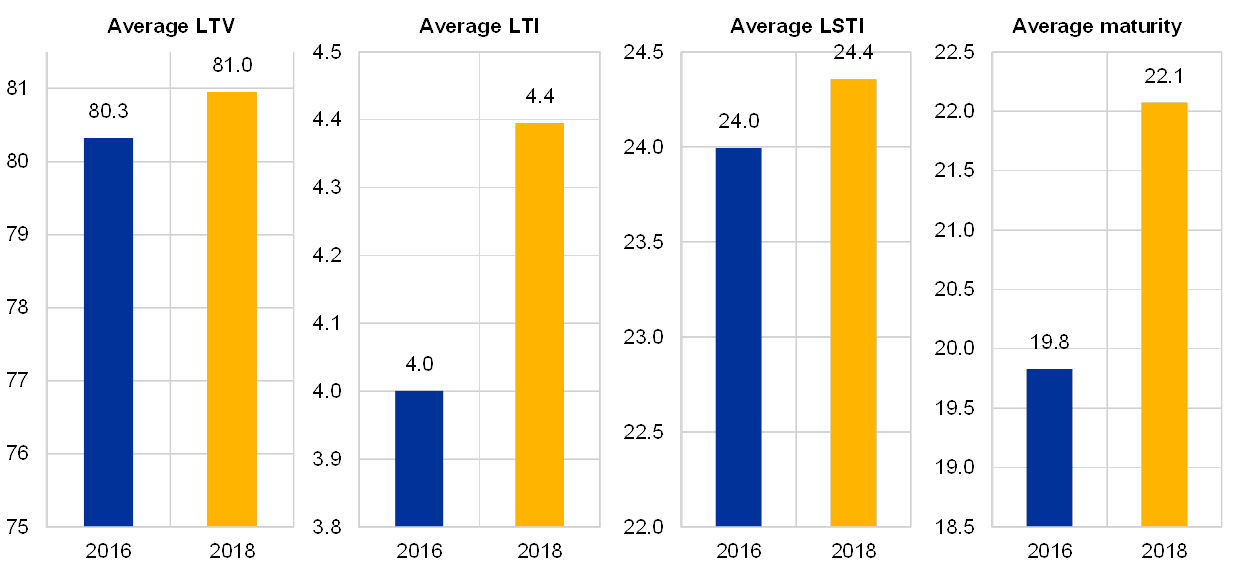

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

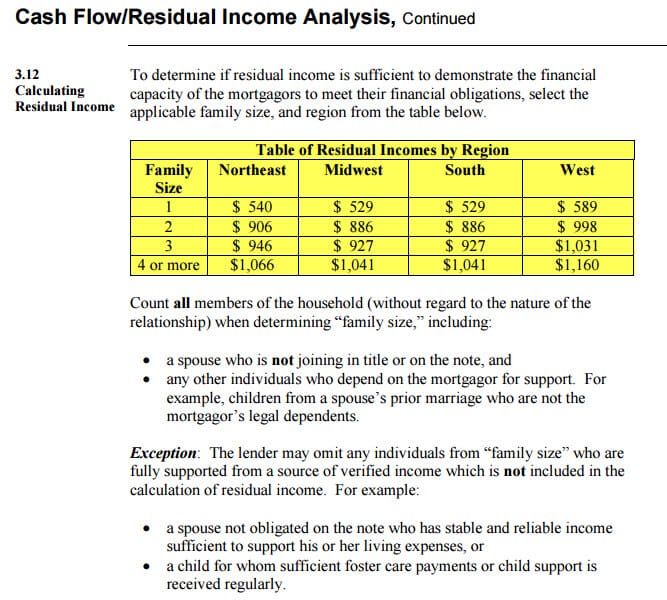

Here Are The Income Requirements For A Reverse Mortgage

Debt To Income Ratio Calculating Your Dti Mint

Debt To Income Ratio Dti Ratio Formula Idfc First Bank

How To Calculate Your Debt To Income Ratio Rocket Money

Va Loan Debt To Income Ratio Dti For Va Loan Socal Va Homes

Great Advice On How To Get A Loan With A High Debt To Income Dti Ratio Moreira Team Mortgage

What S A Good Debt To Income Ratio For A Mortgage

How To Get A Loan With A High Debt To Income Ratio 2023

Debt To Income Ratio For A Mortgage What Is A Dti Ratio Loan Corp

Understanding Dti And Why It Matters Right By You Mortgage

Va Loan With High Dti Mortgage Guidelines

Va Loan Debt To Income Ratio Dti For Va Loan Socal Va Homes

How To Calculate Debt To Income Dti Ratios Mortgage Math Nmls Test Tips Youtube

Fha Dti Ratios On Manual Underwrites Mortgage Guidelines

How Will Debt To Income Ratios Affect Property Investors Opes

What S A Good Debt To Income Ratio For A Mortgage